Understanding how a mortgage works helps you get ahead in the financial game.

A mortgage is a debt paid over time unlike rent that can be adjusted (usually increased not decreased) at the whim of the landlord, the mortgage is a contract with set terms.

Yes it’s probably the biggest debt we personally take on in life, but we all hope that the debt is gone when we are in retirement age.

So how does a mortgage work:

A mortgage is a debt that is secured or against the property. The property can be sold to pay the debt off if the borrower doesn’t pay. Called foreclosure.

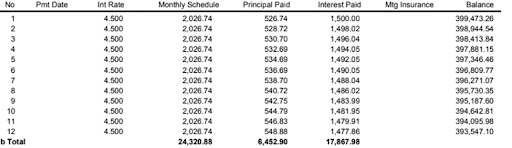

Mortgages are paid in monthly payments and have a portion that goes to principal and interest in every payment. This is the AMORTIZATION or killing off literally of the debt. The principal is the money that goes to pay down the debt paying back what you borrowed, and the interest is what you owe for using the mortgage lender’s money.

Mortgages have more interest in the first years, at he half way point it’s about 50/50 and then more and more principal reduction (payback of the loan) in the last years. See the graph down below.

If you take out a 30 year fixed rate mortgage this looks like a very slow process compared to taking out a 15 year fixed.

See our video on how to speed this up 5 tips to shave years off your mortgage.

Imagine a hour glass or scale that with each payment a little goes to the principal side instead of the interest side. And with each payment more and more goes to the principal until most and final payment ALL is principal (debt payoff)

See graph

First year of payment and breakdown of principal and interest:

The life of the loan:

Sometimes a mortgage payment will include taxes and insurance (mandatory with FHA and VA and less than 10% down with Fannie Mae) but this is not the mortgage those are in addition to paying off the debt.